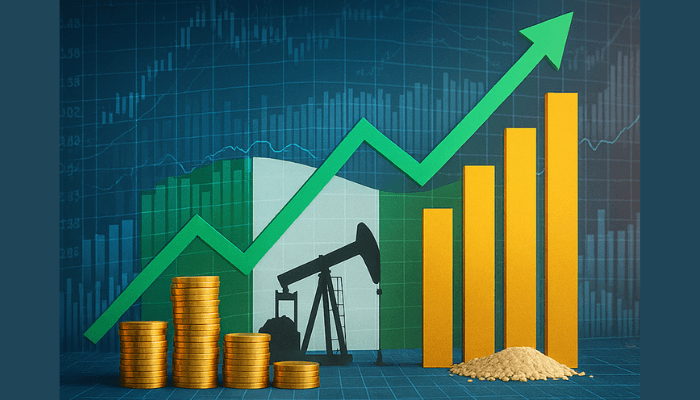

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the States

First published in VANGUARD on January 31, 2026 https://www.vanguardngr.com/2026/01/islands-of-credibility-nigerias-best-reform-strategy-starts-in-the-states/

Nigeria’s reform debate keeps circling the wrong question. The country does not lack policy knowledge. It lacks credible commitment.

Investors and citizens have heard the speeches before: unify the exchange rate, improve the business climate, digitize land records, fix power, streamline taxes, curb corruption. In the abstract, Nigeria knows what to do. What markets doubt is whether Nigeria will do it consistently, enforce it fairly, and sustain it beyond the next political cycle.

That doubt is not a matter of pessimism. It is a rational response to incentives. Where discretionary control over permits, contracts, land, and enforcement generates rents, reform threatens a revenue model, both political and private. In such an environment, “reform” often becomes a performance; announce the rule, preserve the loopholes, and keep discretion alive under new branding.

Here is the practical implication: if national credibility is hard to supply because the center sits atop a dense architecture of discretion, Nigeria should stop waiting for uniform top-down transformation. It should leverage what it already has, federalism, to create subnational “islands of credibility”: states that offer verifiable, rule-bound governance bundles that investors can trust and that other states can copy.

This is not idealized decentralization. It is a strategy for escaping a credibility trap.

Credibility is the scarce input

Capital is not soft-hearted. It does not invest in visions; it invests in enforceable rules. The modern economy is built on irreversible commitments, factories, farms, warehouses, fiber networks, housing developments, processing plants. These investments cannot be packed into a suitcase when politics changes. That is why investors price credibility as a hard input, the way they price electricity or security.

When credibility is low, capital still comes, but it comes differently. It prefers short horizons, quick liquidity, and extractive trades, arbitrage, imports, currency games, politically protected monopolies. It avoids long-horizon capital formation that would raise productivity and wages. The economy becomes busy but not transformational. Growth becomes episodic rather than compounding.

If you want a single sentence summary of Nigeria’s investment challenge, it is this: Nigeria is not underfunded in ideas; it is undercapitalized in credibility.

Why the states matter more than the center

Nigeria’s federal system is often discussed as a source of fragmentation. It can also be a solution to the credibility problem.

Start with land because land is where investment becomes real. Under Nigeria’s legal structure, state governments control the administration of land in critical ways. Whatever else investors worry about; they cannot build without land certainty. A land system that is slow, discretionary, and opaque operates like a tax on capital formation. A land system that is digitized, searchable, and rule-bound can unlock investment faster than almost any national-level slogan.

States also control many of the daily frictions that determine whether “ease of doing business” is real; permits, inspections, local levies, physical planning approvals, procurement execution, and the routine interactions between firms and government offices. These are the points where discretion becomes monetizable and where credibility can be built if states choose to build it.

Why can a state sometimes do what the center struggles to do? Because the scale of coalition management is smaller, accountability can be sharper, and institutional iteration can be faster. A governor who wants to compete for factories, logistics hubs, and tax base can implement tangible reforms within a year; digitize processes, publish fee schedules, enforce service timelines, and remove predatory intermediaries. The point is not that states are morally superior. The point is that they can be more transparent, and transparency is an ingredient of credibility.

What an “island of credibility” actually is

The phrase can sound abstract. It shouldn’t. An island of credibility is a state that can credibly offer investors a compact of rule-bound governance, a bundle, not a single reform. Investors do not care about one shiny portal if everything else remains arbitrary. They care about whether the overall experience is predictable.

A serious “credibility bundle” has five components:

1. Property rights you can verify. Digitized land records. Searchable titles. Transparent fees. Time-stamped workflows. A credible system for consents and transfers. Most important: fewer human chokepoints where “facilitation” becomes mandatory.

2. Tax predictability. Consolidated levies. Published schedules. E-payment. A clear enforcement code that limits discretionary harassment. One portal, one set of rules, one receipt.

3. Permitting and inspections that follow published procedures. Process maps. Service timelines. Standardized checklists. A complaint mechanism that is actually used. Investors can tolerate a strict rule; they cannot tolerate a rule that changes depending on who is asking.

4. Procurement transparency and payment discipline. E-procurement. Open award data. Contract publication. A track record of paying contractors on time. A grievance process for bidders. The state that pays reliably builds a reputation that attracts serious firms and lowers its own project costs.

5. A fast pathway for commercial dispute resolution. Specialized commercial dockets or fast-track procedures. Case management that reduces registry discretion. Court-connected ADR (Alternative Dispute Resolution) options. Investors cannot price a dispute system where resolution takes “as long as it takes.”

Put differently: credibility is not rhetoric. Credibility is a set of verifiable administrative behaviors that shrink discretion.

Competition makes credibility contagious

The most powerful feature of federalism is not autonomy; it is competition.

When a state becomes credibly investable, it creates a demonstration effect. It proves, in Nigerian conditions, that reforms can work. That proof does something national reform speeches cannot: it changes beliefs.

Investors update. Entrepreneurs relocate. Workers migrate. Vendors follow. Internally generated revenue rises. The state’s political class learns that rule-bound governance can be monetized through growth rather than through predation. Neighboring states observe that success and face a choice; keep selling friction, or compete by removing it.

This is how credibility becomes contagious, not through lectures about best practices, but through visible outcomes and reputational pressure.

Nigeria should formalize this competition. It should treat credibility like a competitive product and make it measurable. A quarterly “State Credibility Dashboard (SCD),” based on simple indicators, would change the political economy. It would make it harder to pretend. It would also allow serious investors to compare states with more precision than headlines permit.

A credible dashboard does not need 200 metrics. It needs a dozen, reported consistently: median days to obtain key land documents, percentage of land applications trackable online, percentage of procurement awards published and time from award to payment, median permit processing time for common business approvals, number of consolidated levies and share of collections via e-payment, median time to disposition for commercial fast-track cases, and complaint volumes and resolution times across the key agencies.

When these metrics are public and audited, states will compete on them. And what gets competed on gets improved.

“But won’t states just sell favors?”

They might, if Nigeria misunderstands what competition should reward.

There is a real risk that states compete the wrong way; by offering arbitrary exemptions, sweetheart deals, and personalized “investment packages.” That is not credibility; that is discretion in a suit. It attracts opportunistic capital, not durable capital.

The strategy must therefore be explicit; states should compete on rules, not favors. Performance incentives, whether from the federal government, donors, or domestic institutions, should reward verifiable institutional reforms, not discretionary giveaways.

Another risk is that credibility collapses when a governor leaves office. That is why “islands” must be institutional, not personal. Digitization helps because it creates audit trails. Published fee schedules help because they create public reference points. Service timelines help because they allow businesses to document violations. The goal is to make opportunistic reversal costly, both reputationally and administratively.

There is also the security problem. No business climate survives pervasive insecurity. States cannot solve this alone, but credible states can coordinate better; establish investment protection protocols, improve local policing intelligence, and create industrial clusters with hardened infrastructure. Credibility is never purely legal; it is also physical.

What Global Investors should understand

For global business readers, Nigeria is often seen through two lenses: macro headlines and political drama. Both matters. But Nigeria’s investment story is increasingly subnational.

The practical question for global firms is no longer “Is Nigeria investable?” The question is “Which Nigerian states are becoming reliably investable, and how quickly are they improving?”

That lens should change how capital is allocated. If a state can demonstrate rule-bound land administration, predictable taxes, transparent procurement, and a functional dispute pathway, it can attract investment even when national credibility is still under construction. Conversely, if a state cannot provide basic administrative predictability, no national reform speech will compensate.

A concrete agenda Nigeria can implement now

Nigeria does not need a constitutional overhaul to begin. It needs a federalism strategy focused on credibility production.

Three steps would move the system quickly.

First: define the credibility bundle. Federal and state reform leaders should agree on a minimal, non-negotiable set of reforms, land workflow digitization, procurement transparency, tax consolidation, permitting service standards, and commercial dispute pathways. The objective is not utopia; it is verifiable improvement.

Second: publish and audit a state credibility scoreboard. A simple dashboard, updated quarterly, would change incentives. It would give investors a tool. It would give citizens a measure. It would give governors a reputational contest they can win through performance rather than patronage.

Third: pay for credibility, conditionally. Building credibility costs money; systems, training, audits, reform teams, modernization of registries. Nigeria should use performance-based grants and conditional transfers to co-finance the reforms, releasing funds only when metrics are met and verified. This turns credibility into a budget-relevant strategy for governors.

If Nigeria does these three things, it will begin to see a different kind of reform dynamic: less national theatrics, more local proof. Less reliance on promises, more reliance on measurement. Less politics of vague virtue, more politics of competitive performance.

Nigeria’s most realistic path is not uniform excellence

The central mistake in Nigeria’s reform imagination is the belief that national credibility must be built everywhere, all at once, from the top. That approach sets the bar so high that disappointment becomes inevitable.

Nigeria’s more realistic path is modular; build credibility where it is feasible, make it visible, let it attract capital, and allow success to diffuse through competition and imitation. In a country with 36 states, development does not have to wait for universal agreement. It can begin where governance chooses to become predictable.

Nigeria knows what to do. The question is not whether the blueprint exists. The question is whether Nigeria will use federalism to produce credible commitment in places investors can verify, and then allow those places to prove that a rules-based economy is not a foreign concept, but a Nigerian possibility.

If Nigeria can create a few islands of credibility, the mainland will not remain unchanged for long.

_____

Philip Obazee retired as a managing director and head of derivatives from Macquarie Asset Management – a global asset management company with office in Philadelphia, PA, USA, and currently, he is the founder and chief executive officer of Polymetrics Americas Research.

Leave a comment